To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behaviour or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Inrix has published its annual Global Traffic Scorecard that claims to identify and rank congestion and mobility trends in more than 200 cities across 38 countries. In the UK, the 2018 Traffic Scorecard analysed congestion and the severity of it in the top 20 urban areas. It claims drivers lost an average of 178 hours a year due to congestion, costing them £7.9 billion in 2018, an average of £1,317 per driver. London (227 hours lost due to congestion) and Birmingham (165 hours) ranked as the two most congested cities in the overall impact of congestion ranking.

Inrix has published its annual Global Traffic Scorecard that claims to identify and rank congestion and mobility trends in more than 200 cities across 38 countries. In the UK, the 2018 Traffic Scorecard analysed congestion and the severity of it in the top 20 urban areas. It claims drivers lost an average of 178 hours a year due to congestion, costing them £7.9 billion in 2018, an average of £1,317 per driver. London (227 hours lost due to congestion) and Birmingham (165 hours) ranked as the two most congested cities in the overall impact of congestion ranking.

The office sector in Belfast has enjoyed its most successful year on record, with 885,023 sq ft of take-up reported across 84 transactions, more than double that was achieved last year, according to CBRE’s Offices Marketview research. Notable office deals completed in 2018 include PwC’s move to Merchant Square, Northern Ireland Civil Service to 9 Lanyon Place, Allstate to Mays Meadow, TLT to River House and Baker McKenzie to City Quays 2. According to CBRE Northern Ireland Office the local office market’s record breaking year is an indicator of the resilience of the commercial property market as well as the wider Northern Ireland economy.

The office sector in Belfast has enjoyed its most successful year on record, with 885,023 sq ft of take-up reported across 84 transactions, more than double that was achieved last year, according to CBRE’s Offices Marketview research. Notable office deals completed in 2018 include PwC’s move to Merchant Square, Northern Ireland Civil Service to 9 Lanyon Place, Allstate to Mays Meadow, TLT to River House and Baker McKenzie to City Quays 2. According to CBRE Northern Ireland Office the local office market’s record breaking year is an indicator of the resilience of the commercial property market as well as the wider Northern Ireland economy.

A lack of senior stakeholder support is the greatest inhibitor of change, new research suggests as despite considerable enthusiasm to innovate, organisations are being thwarted by tight resources and strong internal resistance. The data commissioned by KCOM found that organisations are also limiting themselves by turning away the specialist skills and experience that could help them advance, through overly predictive procurement processes. They are however, eager to be more competitive, which is why organisations are making big investments in innovation projects. Almost half (43 percent) consider driving digital transformation to improve competitive advantage to be their top priority in the next year. A further 32 percent are allocating at least 20 percent of their IT budget to new projects. Both public and private sector organisations are also taking an increasingly people-centric approach to digital transformation. In the next year, 80 percent said they would incentivise staff retention through training, accreditation and career development to deliver on their innovation strategy. This is compared to 71 percent who said they would do so by investing in new technologies.

A lack of senior stakeholder support is the greatest inhibitor of change, new research suggests as despite considerable enthusiasm to innovate, organisations are being thwarted by tight resources and strong internal resistance. The data commissioned by KCOM found that organisations are also limiting themselves by turning away the specialist skills and experience that could help them advance, through overly predictive procurement processes. They are however, eager to be more competitive, which is why organisations are making big investments in innovation projects. Almost half (43 percent) consider driving digital transformation to improve competitive advantage to be their top priority in the next year. A further 32 percent are allocating at least 20 percent of their IT budget to new projects. Both public and private sector organisations are also taking an increasingly people-centric approach to digital transformation. In the next year, 80 percent said they would incentivise staff retention through training, accreditation and career development to deliver on their innovation strategy. This is compared to 71 percent who said they would do so by investing in new technologies.

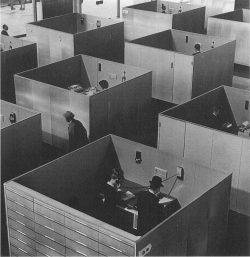

Despite the fact that a large number of employees continue to be relatively sedentary during their working day, there a growing demand for benefits that could help them achieve a healthier lifestyle, claims new research from Personal Group. More than 40 percent of employees surveyed want health insurance to be added to their workplace benefits programme; more than a third (34 percent) would like their employer to introduce discounted gym memberships, and more than one in four (28 percent) want to have access to rewards linked to physical activity. Almost a quarter (24 percent) want physical health-based incentives, such as interdepartmental step challenges or competitions added to their company-wide benefits programme. However, data shows that 70 percent of those surveyed who sit down to work only get up from their desk or workstation every hour at best, and 38 percent only move every two hours or more. Furthermore, a large proportion of employees eat at their desk or workstation on a regular basis (32 percent) and the majority choose to drive to work (60 percent) over walking (15 percent) or cycling (3.5 percent).

Despite the fact that a large number of employees continue to be relatively sedentary during their working day, there a growing demand for benefits that could help them achieve a healthier lifestyle, claims new research from Personal Group. More than 40 percent of employees surveyed want health insurance to be added to their workplace benefits programme; more than a third (34 percent) would like their employer to introduce discounted gym memberships, and more than one in four (28 percent) want to have access to rewards linked to physical activity. Almost a quarter (24 percent) want physical health-based incentives, such as interdepartmental step challenges or competitions added to their company-wide benefits programme. However, data shows that 70 percent of those surveyed who sit down to work only get up from their desk or workstation every hour at best, and 38 percent only move every two hours or more. Furthermore, a large proportion of employees eat at their desk or workstation on a regular basis (32 percent) and the majority choose to drive to work (60 percent) over walking (15 percent) or cycling (3.5 percent).