June 19, 2018

A clearer more enforceable energy efficiency policy is needed for commercial buildings

There is a critical need for to simplify the regulatory framework designed to improve energy efficiency in commercial buildings finds a recent report from the Environmental Industries Commission (EIC) Carbon Management & Sustainable Buildings Working Group. It also suggests that Brexit could act as a spur to rethink the right combination of policies to reform enforcement systems. The report, Improving non-domestic energy efficiency after Brexit, one of a series EIC is publishing setting out its members’ views on the impact of Brexit on environmental policy and how policy should evolve after the UK leaves the EU, covers the breadth of energy efficiency policy for non-domestic buildings. As part of its research, EIC surveyed England’s local authorities, who have responsibility for trading standards, finding that out of those that responded (122 out of 149), no local authorities have been issuing fines for failing to display Energy Performance Certificates or Display Energy Certificates.

There is a critical need for to simplify the regulatory framework designed to improve energy efficiency in commercial buildings finds a recent report from the Environmental Industries Commission (EIC) Carbon Management & Sustainable Buildings Working Group. It also suggests that Brexit could act as a spur to rethink the right combination of policies to reform enforcement systems. The report, Improving non-domestic energy efficiency after Brexit, one of a series EIC is publishing setting out its members’ views on the impact of Brexit on environmental policy and how policy should evolve after the UK leaves the EU, covers the breadth of energy efficiency policy for non-domestic buildings. As part of its research, EIC surveyed England’s local authorities, who have responsibility for trading standards, finding that out of those that responded (122 out of 149), no local authorities have been issuing fines for failing to display Energy Performance Certificates or Display Energy Certificates.

Take up of commercial office leases in London’s West End had its strongest start to the year since 2012, with the banking and finance sector continuing to actively seek space, new figures from CBRE have revealed. The amount of office space under offer on in Central London at the end of Q1 2018 stood at 3.2m sq ft, representing an increase of 6 percent on the previous quarter and showing a 3 percent increase on the same point last year. Take-up in Central London reached 2.8m sq ft in Q1 2018, with its largest deal boasting a 65,900 sq ft letting to WS Atkins at Nova North in Victoria. Availability in Central London increased by 7 percent to 14.3m sq ft but that is still below the total 12 months ago. A total of 1.1m sq ft of development and refurbishment space completed in Q1. A further 2.3m sq ft is expected to complete before the end of the year, of which 54 percent has already been committed to be leased. By the end of the quarter, 9.1m sq ft was being actively sought by occupiers, primarily from the banking and finance sector (26 percent) and creative industries sector (24 percent).

Take up of commercial office leases in London’s West End had its strongest start to the year since 2012, with the banking and finance sector continuing to actively seek space, new figures from CBRE have revealed. The amount of office space under offer on in Central London at the end of Q1 2018 stood at 3.2m sq ft, representing an increase of 6 percent on the previous quarter and showing a 3 percent increase on the same point last year. Take-up in Central London reached 2.8m sq ft in Q1 2018, with its largest deal boasting a 65,900 sq ft letting to WS Atkins at Nova North in Victoria. Availability in Central London increased by 7 percent to 14.3m sq ft but that is still below the total 12 months ago. A total of 1.1m sq ft of development and refurbishment space completed in Q1. A further 2.3m sq ft is expected to complete before the end of the year, of which 54 percent has already been committed to be leased. By the end of the quarter, 9.1m sq ft was being actively sought by occupiers, primarily from the banking and finance sector (26 percent) and creative industries sector (24 percent).

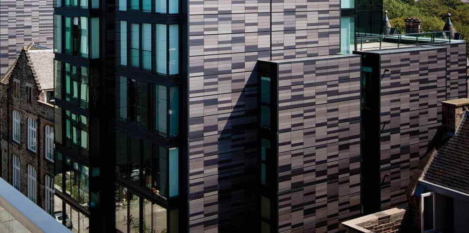

Technology, media, and telecommunications (TMT) companies are continuing to play a prominent role within Edinburgh’s office market, accounting for approximately 30 percent of transactions in the city. But rising demand for Grade A office space in Edinburgh by a variety of organisations, including coworking, private and public sector tenants has fuelled significant occupier demand during the first quarter of 2018, according to analysis by property consultancy, Knight Frank. The latest commercial property figures show approximately 460,000 sq. ft. of new occupier requirements came onto the market in the first three months of the year from companies looking to lease office space in Edinburgh.

Technology, media, and telecommunications (TMT) companies are continuing to play a prominent role within Edinburgh’s office market, accounting for approximately 30 percent of transactions in the city. But rising demand for Grade A office space in Edinburgh by a variety of organisations, including coworking, private and public sector tenants has fuelled significant occupier demand during the first quarter of 2018, according to analysis by property consultancy, Knight Frank. The latest commercial property figures show approximately 460,000 sq. ft. of new occupier requirements came onto the market in the first three months of the year from companies looking to lease office space in Edinburgh.

March 8, 2018

Data, AI and the commercial property sector – what’s the connection?

by Nick Riesel • Comment, Property, Technology

More →