April 9, 2018

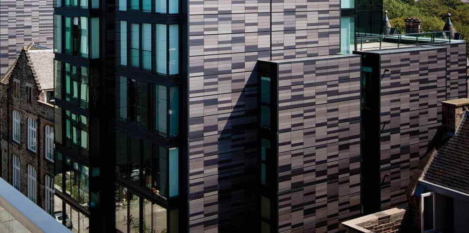

Rising demand for Grade A office space helps sustain Edinburgh commercial property market

Technology, media, and telecommunications (TMT) companies are continuing to play a prominent role within Edinburgh’s office market, accounting for approximately 30 percent of transactions in the city. But rising demand for Grade A office space in Edinburgh by a variety of organisations, including coworking, private and public sector tenants has fuelled significant occupier demand during the first quarter of 2018, according to analysis by property consultancy, Knight Frank. The latest commercial property figures show approximately 460,000 sq. ft. of new occupier requirements came onto the market in the first three months of the year from companies looking to lease office space in Edinburgh. (more…)

Technology, media, and telecommunications (TMT) companies are continuing to play a prominent role within Edinburgh’s office market, accounting for approximately 30 percent of transactions in the city. But rising demand for Grade A office space in Edinburgh by a variety of organisations, including coworking, private and public sector tenants has fuelled significant occupier demand during the first quarter of 2018, according to analysis by property consultancy, Knight Frank. The latest commercial property figures show approximately 460,000 sq. ft. of new occupier requirements came onto the market in the first three months of the year from companies looking to lease office space in Edinburgh. (more…)

City centre take up reached 1,005,000 sq ft in Birmingham last year, 51 percent above the 10-year average of 666,000 sq ft which marked a record year, according to Savills Research. Growth was driven in part by the Government Property Unit (GPU) deal, as public services accounted for 27 percent of take-up in the city centre last year, including the 237,000 sq ft pre-let at Arena Central. Birmingham’s boom was also boasted by take-up from serviced office providers that reached 208,000 sq ft during 2017, the highest level on record and this accounted for 21 percent of the total take-up, more than any other regional city. There now remains a shortage of Prime Grade A space in Birmingham city centre following a number of large lettings. Prime Grade A space now stands at only 169,000 sq ft, enough for only six months of take-up at average levels. Major construction project, Three Snowhill won’t complete until the second quarter of next year, when it will deliver 420,000 sq ft of much needed Grade A office space on its completion. Until then, competition among occupiers will further intensify for Grade A space.

City centre take up reached 1,005,000 sq ft in Birmingham last year, 51 percent above the 10-year average of 666,000 sq ft which marked a record year, according to Savills Research. Growth was driven in part by the Government Property Unit (GPU) deal, as public services accounted for 27 percent of take-up in the city centre last year, including the 237,000 sq ft pre-let at Arena Central. Birmingham’s boom was also boasted by take-up from serviced office providers that reached 208,000 sq ft during 2017, the highest level on record and this accounted for 21 percent of the total take-up, more than any other regional city. There now remains a shortage of Prime Grade A space in Birmingham city centre following a number of large lettings. Prime Grade A space now stands at only 169,000 sq ft, enough for only six months of take-up at average levels. Major construction project, Three Snowhill won’t complete until the second quarter of next year, when it will deliver 420,000 sq ft of much needed Grade A office space on its completion. Until then, competition among occupiers will further intensify for Grade A space.

March 8, 2018

Data, AI and the commercial property sector – what’s the connection?

by Nick Riesel • Comment, Property, Technology

(more…)