April 28, 2017

Government failing to meet goals for an integrated real estate portfolio 0

The UK Government is getting better value for money from its estate, according to a new report from the National Audit Office. The Government Property Unit (GPU), however, has not yet made much progress towards its objective of creating a shared, flexible and integrated estate. The government’s central estate includes some 4,600 individual holdings, costing around £2.55 billion a year to run. The GPU, which is part of the Cabinet Office, was set up in 2010 to better co-ordinate estate management in the public sector. Since the NAO’s last report in 2012, departments have continued to make good progress in reducing the overall size of the central estate. They have also reduced overall estate spending and pay less for office accommodation than private sector comparators. Departments report they have reduced their annual estate costs by £775 million in real terms since 2011-12 to around £2.55 billion in 2015-16. Between 2011-12 and 2015-16, departments raised £2.5 billion by selling surplus land and properties. The GPU is also starting to have an impact on the wider public estate.

The UK Government is getting better value for money from its estate, according to a new report from the National Audit Office. The Government Property Unit (GPU), however, has not yet made much progress towards its objective of creating a shared, flexible and integrated estate. The government’s central estate includes some 4,600 individual holdings, costing around £2.55 billion a year to run. The GPU, which is part of the Cabinet Office, was set up in 2010 to better co-ordinate estate management in the public sector. Since the NAO’s last report in 2012, departments have continued to make good progress in reducing the overall size of the central estate. They have also reduced overall estate spending and pay less for office accommodation than private sector comparators. Departments report they have reduced their annual estate costs by £775 million in real terms since 2011-12 to around £2.55 billion in 2015-16. Between 2011-12 and 2015-16, departments raised £2.5 billion by selling surplus land and properties. The GPU is also starting to have an impact on the wider public estate.

Employees coming into work when sick are contributing to a rising trend of ‘presenteeism’ across the UK, with more than half (52 percent) of UK workers admitting to going to work when their performance is negatively affected by work-related health issues, a new survey claims. A third (34 percent) of workers have even considered moving jobs due to the negative impact of their work environment on their health – the highest percentage across Europe. The report from Fellowes, published to coincide with World Day for Safety and Health at Work, argues when a worker is present but not able to perform their function properly, it compromises their productivity. With most employees continuing to work at sub-par levels rather than taking days off to recover, this also prolongs the effect of illness. Subsequently, businesses are experiencing a detrimental knock-on impact on the quality and volume of work produced, with a further impact on overall business performance.

Employees coming into work when sick are contributing to a rising trend of ‘presenteeism’ across the UK, with more than half (52 percent) of UK workers admitting to going to work when their performance is negatively affected by work-related health issues, a new survey claims. A third (34 percent) of workers have even considered moving jobs due to the negative impact of their work environment on their health – the highest percentage across Europe. The report from Fellowes, published to coincide with World Day for Safety and Health at Work, argues when a worker is present but not able to perform their function properly, it compromises their productivity. With most employees continuing to work at sub-par levels rather than taking days off to recover, this also prolongs the effect of illness. Subsequently, businesses are experiencing a detrimental knock-on impact on the quality and volume of work produced, with a further impact on overall business performance.

New guidance to help facilities managers manage the transition to agile working within their organisation has just been published by the British Institute of Facilities Management (BIFM). The Agile Working Change Management Guidance Note is aimed at FMs working at a senior and/or operational level and covers the benefits of agile working and how to successfully plan and implement an integrated approach to deliver sustainable change in working behaviour. Agile working describes a range of work settings that allow people and organisations to make new choices about when, where and how they work. It is underpinned by mobile technology and applies to people working both in and away from the traditional office, such as at home, on the road or remotely in other locations. BIFM’s research and information manager Peter Brogan said: “As an Institute, we recognise the importance of the workplace agenda for FMs and this newly commissioned Guidance Note aims to address the current lack of knowledge around some of the emerging workplace practices.”

New guidance to help facilities managers manage the transition to agile working within their organisation has just been published by the British Institute of Facilities Management (BIFM). The Agile Working Change Management Guidance Note is aimed at FMs working at a senior and/or operational level and covers the benefits of agile working and how to successfully plan and implement an integrated approach to deliver sustainable change in working behaviour. Agile working describes a range of work settings that allow people and organisations to make new choices about when, where and how they work. It is underpinned by mobile technology and applies to people working both in and away from the traditional office, such as at home, on the road or remotely in other locations. BIFM’s research and information manager Peter Brogan said: “As an Institute, we recognise the importance of the workplace agenda for FMs and this newly commissioned Guidance Note aims to address the current lack of knowledge around some of the emerging workplace practices.”

More than six in ten workers value happiness at work over salary and even those more motivated by salary agree that a setting that allows friendships to flourish could provide invaluable benefits for businesses, a new survey suggests. The research by Wildgoose found that 57 percent of respondents thought having a best friend in the office made their time at work more enjoyable, almost a third were more productive and over one in five said it boosted their creativity. The survey also highlighted the differences in attitudes across various groups and demographics. Women were far more likely to prioritise happiness, with eight in ten placing it above salary, compared to just 55 percent of males. The job level of an employee also played a significant role. For 85 percent of managers, salary was deemed more important, while 70 percent of entry-level, interns, and executives chose happiness.

More than six in ten workers value happiness at work over salary and even those more motivated by salary agree that a setting that allows friendships to flourish could provide invaluable benefits for businesses, a new survey suggests. The research by Wildgoose found that 57 percent of respondents thought having a best friend in the office made their time at work more enjoyable, almost a third were more productive and over one in five said it boosted their creativity. The survey also highlighted the differences in attitudes across various groups and demographics. Women were far more likely to prioritise happiness, with eight in ten placing it above salary, compared to just 55 percent of males. The job level of an employee also played a significant role. For 85 percent of managers, salary was deemed more important, while 70 percent of entry-level, interns, and executives chose happiness.

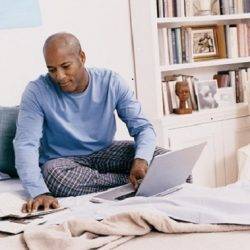

A majority of workers (65 percent) now feel comfortable requesting to work from home, while a third (33 percent) of UK employees would decline a job offer if they weren’t able to work flexibly. This is according to a new study from Maintel which claims that today’s multi-generational workforce prefers flexible working to traditional office hours and location; with flexible work policies perceived as an important workplace benefit. Nearly three quarters (73 percent) of respondents say the company they work for has good flexible work policies in place, 64 percent of remote workers don’t feel micromanaged, and 58 percent would take the opportunity to spend even less time in an office, if it were available. Well over half (60 percent) of respondents believe technology can replace in-person interaction in the workplace. Yet there remain challenges with flexible work, including indifference regarding the security of company data (66 percent) and distractions at home (31 percent).

A majority of workers (65 percent) now feel comfortable requesting to work from home, while a third (33 percent) of UK employees would decline a job offer if they weren’t able to work flexibly. This is according to a new study from Maintel which claims that today’s multi-generational workforce prefers flexible working to traditional office hours and location; with flexible work policies perceived as an important workplace benefit. Nearly three quarters (73 percent) of respondents say the company they work for has good flexible work policies in place, 64 percent of remote workers don’t feel micromanaged, and 58 percent would take the opportunity to spend even less time in an office, if it were available. Well over half (60 percent) of respondents believe technology can replace in-person interaction in the workplace. Yet there remain challenges with flexible work, including indifference regarding the security of company data (66 percent) and distractions at home (31 percent).

A major research study into Health and Wellbeing in offices has been launched by the British Council for Offices (BCO). “Wellness Matters: Health and Wellbeing in offices and what to do about it” is a year-long project which aims to provide definitive guidance on how to enable office Health and Wellbeing across a building’s lifecycle. The major research study has been commissioned to critique existing Health and Wellbeing measurement and certification, identify the most recent and relevant medical evidence justifying a proactive approach to Health and Wellbeing in the built environment, and give guidance on the business case for investment in this space beyond simply improving productivity. Most significantly, this research aims to deliver a practical guide to creating a healthy environment across the different stages of a building’s life cycle, from design, construction and leasing to the most important aspect by time and value: occupation and asset management.

A major research study into Health and Wellbeing in offices has been launched by the British Council for Offices (BCO). “Wellness Matters: Health and Wellbeing in offices and what to do about it” is a year-long project which aims to provide definitive guidance on how to enable office Health and Wellbeing across a building’s lifecycle. The major research study has been commissioned to critique existing Health and Wellbeing measurement and certification, identify the most recent and relevant medical evidence justifying a proactive approach to Health and Wellbeing in the built environment, and give guidance on the business case for investment in this space beyond simply improving productivity. Most significantly, this research aims to deliver a practical guide to creating a healthy environment across the different stages of a building’s life cycle, from design, construction and leasing to the most important aspect by time and value: occupation and asset management.